When it comes to car insurance, rates can vary significantly depending on where you live. In Kentucky, car insurance rates are influenced by several factors, including state regulations, the type of coverage you choose, and personal driving history. Understanding these factors is crucial for drivers looking to save on their premiums while ensuring they’re adequately covered in the event of an accident.

Average Car Insurance Rates in Kentucky

The average cost of car insurance in Kentucky tends to be higher than the national average, though it’s still within a reasonable range for most drivers. As of recent data, the average annual premium for car insurance in Kentucky is about $1,400. However, your specific premium will depend on various factors, including your driving history, vehicle type, location, and the amount of coverage you select.

Factors Affecting Car Insurance Rates in Kentucky

Several elements contribute to the variation in car insurance rates in the state. Here’s a breakdown of the most important factors:

1. State Minimum Coverage Requirements

Kentucky is a no-fault state, which means that drivers must carry personal injury protection (PIP) insurance in addition to liability coverage. The minimum required coverage in Kentucky includes:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident

- Property Damage Liability: $10,000

- Personal Injury Protection (PIP): $10,000

- Uninsured/Underinsured Motorist Coverage: This is also mandatory in Kentucky, with minimums of $25,000 per person and $50,000 per accident.

While these are the minimum requirements, many drivers choose to purchase additional coverage to better protect themselves in case of an accident. Opting for higher coverage limits or adding comprehensive and collision insurance can increase your premium but provides greater financial protection.

2. Driving History and Claims History

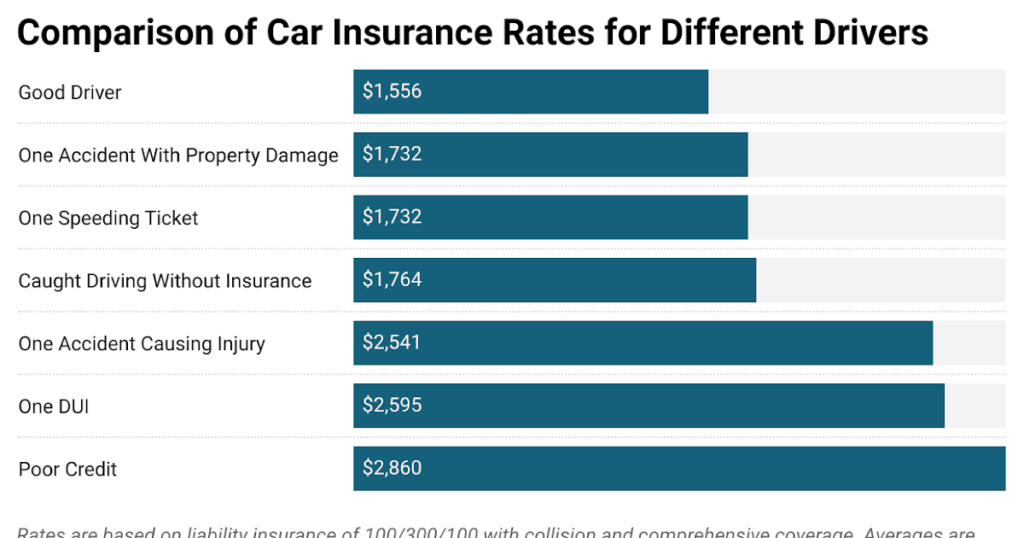

Just like in other states, your driving record plays a significant role in determining your car insurance rates in Kentucky. Drivers with a clean record will likely pay lower premiums, while those with a history of accidents, traffic violations, or claims may face higher rates.

Insurance companies consider your driving history as a predictor of future risk. If you’ve been involved in accidents or have received tickets for speeding or DUI violations, expect your rates to be higher. In some cases, you may be required to pay for high-risk insurance policies.

3. Location and Traffic Density

Where you live in Kentucky can also impact your car insurance rates. Urban areas like Louisville and Lexington typically experience higher premiums than rural areas due to the increased risk of accidents, theft, and vandalism in densely populated areas. In contrast, drivers in less populated regions may see lower premiums, but this isn’t always the case.

Weather conditions, particularly in regions prone to flooding or snowstorms, can also influence the cost of insurance. In Kentucky, winter storms and occasional flooding can increase the risk of accidents or vehicle damage, leading to higher rates.

4. Age, Gender, and Marital Status

Insurance companies use statistical data to assess risk, and factors such as age, gender, and marital status come into play. Younger drivers, particularly males under 25, generally pay higher premiums due to their higher risk of being involved in accidents. On the other hand, older drivers with more experience behind the wheel are likely to pay less.

Married individuals often receive discounts, as insurers consider them less risky than single drivers. If you have a good credit history, this can also work in your favor, as many insurance providers in Kentucky use credit scores to help determine rates.

5. Type of Car

The make and model of your vehicle also significantly impact your car insurance rate. High-performance cars, luxury vehicles, and sports cars are typically more expensive to insure because they’re more likely to be involved in accidents and are costlier to repair. On the other hand, sedans or family cars with higher safety ratings may qualify for lower rates.

If you’ve installed safety features or anti-theft devices, this can also help reduce premiums. Features like airbags, anti-lock brakes, and backup cameras can make your vehicle less risky to insure.

Ways to Save on Car Insurance in Kentucky

While Kentucky car insurance rates are influenced by numerous factors, there are ways to lower your premium without sacrificing necessary coverage:

-

Shop Around: Always compare quotes from multiple insurers to find the best rates for your situation. Premiums can vary widely, so it’s important to explore different options.

-

Bundle Your Policies: If you have home or renters insurance, consider bundling it with your car insurance policy to receive a discount.

-

Increase Your Deductible: A higher deductible typically means a lower premium, but be sure you can afford the out-of-pocket costs in the event of a claim.

-

Take Advantage of Discounts: Many insurers offer discounts for good drivers, students with good grades, or those who complete defensive driving courses.

-

Maintain a Good Credit Score: In Kentucky, as in many states, your credit score can impact your insurance rate. Make sure to keep your credit in good standing to receive better offers.

-

Limit Your Coverage on Older Vehicles: If your car is older and has a low market value, you might consider dropping comprehensive or collision coverage to save money.

Conclusion

Car insurance in Kentucky can be more expensive than the national average, but it’s important to shop around and find a policy that fits both your budget and coverage needs. By understanding the factors that influence your rates and taking proactive steps to reduce them, you can ensure you’re getting the best deal possible. Whether you’re a first-time driver or a seasoned motorist, having the right insurance coverage is essential to keeping you safe and financially protected on the road.